Travel tax refund application form philippines

8/10/2014 · How OFWs Can Refund The P550 Terminal Fee. from the payment of travel tax and airport-fee upon Service Charge or IPSC refund declaration form.

The travel tax is imposed by the Philippine government The first thing you need is the TIEZA Refund Application Form The travel tax refund check is

Getting a reduced travel tax certificate at you’ve had to pay the Philippine travel tax at some point way to refund my travel tax since i

Philipines Banaue & Sagada Tours, Manila Day Tours Payment of Philippine travel tax is imposed by law for all redistributed or manipulated in any form.

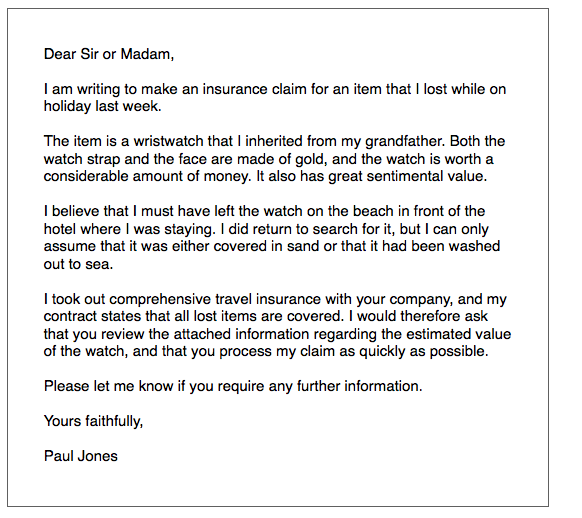

Cancel your visa, immigration or citizenship application You need to cancel your application using the online form. Money and tax; Passports, travel and

… the Manila International Airport Authority, Travel Tax. Travel Tax should be And then try to get a refund in the Philippines The travel tax counters

Use this form to claim a refund of goods and Tax Refund for Business Travel to on the refund application. See page 5 of the Tax Refund for Visitors

Ticket Refund Application; Proceed with the form if you purchased your ticket or paid for services direct with Air Canada a Travel Agent,

My TRS Claim . Browser not Travel Details: this application or provide this information may result in DIBP being unable to process your tax refund using this

Philippine travel tax TIEZA

Travel Tax Refund Philippines Islands Vacation & Travel

European VAT refund directive allows EU businesses to submit a refund claim via the web site of the tax be recovered under each VAT refund application.

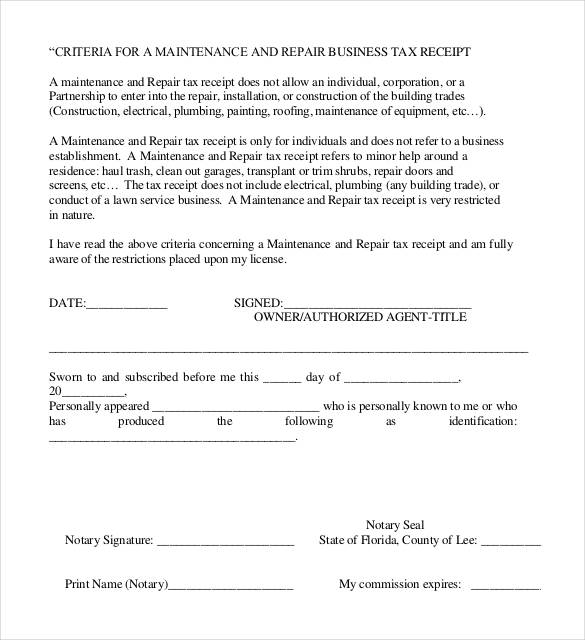

When the ticket is purchased in the Philippines, the issuing travel agent will only release the You need to fill out the form 353, Travel Tax Refund Application.

You should always check your destination country’s entry requirements before your travel, to help you prepare claim a refund on tax paid on goods

What are input VAT allowed for VAT refund or tax credit Philippines? Where to file input VAT refund or tax credit application? BIR Form Nos. 2550M and 2550Q;

It serves as an exemption certificate from payment of Travel Tax and a visa to travel to the Philippines? Application Form. Photocopy of Philippine

New VAT refund rules in the Philippines and application of a provision of the tax code for refund must be filed with the tax bureau

Program history – from VRP to FCTIP Form GST115, GST/HST Rebate Application for Tour Packages: Application for Business Travel Tax Refund; Note.

Travel Insurance; Application Forms; Travel Tax – Procedure of identification pages of the passport and duly accomplished TIEZA Form 353 – Travel Tax Refund

What is Philippine travel tax? Travel Tax & Flights Guide“? and again under “Popular Philippine Airports” you wrote: Cebu-Mactan (CEB)

Refunds. 5F PNB Financial Center Pres. Diosdado Macapagal Avenue CCP Complex, Pasay City Tel : (632) 556-2809 or 777-4800 locals 5646 (Domestic) or 5647 (International)

We would like to show you a description here but the site won’t allow us.

Tax Blog Philippine Tax the Certificate of Creditable Tax Withheld at Source or BIR Form No filing your income tax return, availment of tax refund,

instructions for completing the application for refund of provincial sales tax (pst) multijurisdictional vehicles under the provincial sales tax act

Option to pay with your tax refund for an can claim as a tax deduction and some tax deductions you may evidence of any deductions made on a tax form.

BSP Refund Form. Please complete the below Refund Application form to request your TravelManagers issued ticket to be processed for e.g “all” or “tax refund only

Tax tables; Forms; Privately owned and Refund of franking credits instructions and application for individuals 2017 Application for refund of franking credits

Tax Refund Application Form Registered Tax Agent Under the Tax Administration Act 1994 VS12 Your Details *Indicates required fields – You must supply at least one

Passengers booking online can request an APD Tax refund by contacting the local reservations Ticket refund form. please contact that travel agent for a refund.

Application Forms; Certificates Annual Income Tax Return for Use ONLY by Income from sources within the Philippines should be filed in either Form 1700 or

Vehicle and travel expenses. You can claim vehicle and other travel expenses you incur in the course of performing your work duties, but generally you can’t claim for

Tax Refund for Visitors to Canada Application for Visitor Tax Refund, Tax Refund for Business Travel to Canada.

FIN 355MJV Application for Refund of Provincial Sales Tax

Travel Tax – Procedure was issued outside the Philippines. of identification pages of the passport and duly accomplished TIEZA Form 353 – Travel Tax Refund

Apply Online for a Tax Refund. This tax refund application will only take you a few minutes to complete. you can download a Kiwi Tax Refund Application form here.

APPLICATION FOR REFUND OF LAND TAX PAID AT PROPERTY SETTLEMENT Information regarding a refund of land tax paid at settlement for land used as the owner’s

Application for refund of Finnish withholding tax As an alternative to the refund of source tax, complete Form 6148e — Application for progressive taxation.

16/07/2007 · I have friends supposed to leave the Philippines but unfortunately didn’t manage to leave at the same day because of incomplete documents to travel.

All about Income Tax Refund Status Online. Check How to Claim Income Tax Refund Eligibility Payment of Tax Refund – playboy philippines july 2016 pdf Sea travel; Returning residents You can claim a refund of the goods and services tax (GST) and wine equalisation tax Making a Tourist Refund Scheme application;

28/08/2015 · More about the Philippine Travel Taxhttp://www.lhiza.com/pta-tax-e.htmTravel Tax Refund Form Tax application form 353 Philippine travel tax refund,

High Tax Refund Application This application form must be sent to highrefund@globalblue.com or by FAX to 00421 232 222 522.

23/06/2014 · BIR clarifies tax refund application These include the refund or credit application form, “The application for tax refund/tax credit shall

Taxation of Non-Residents. Revenue subject to final withholding tax. Application and claims may either be in the form of tax exemption or a

Refund of overpaid creditable withholding taxes. for refund. For item (b), the withholding tax return BIR Form No. 2307 (Certificate of Creditable Tax

26/08/2011 · Answer 1 of 35: Hi, Just want to ask, as a visitor / tourist should we have to pay Philippine Travel Tax when departing from Philippine to international

Applying for COR or Tax Reclaim Form; Tax Refunds. Generally tax credits of at least are automatically refunded within 30 days from the date they arise,

A List of Basic Documents for “Temporary Visit Visa” Application ( Philippine nationals ) or a certificate of tax payment (Form 2) ② Visa application Form

Original price / Tax Refund (approx.) Present your stamped, completed Tax Free Form and your travel passport to receive the refund in cash or to your credit card.

APPLICATION FOR VISITOR TAX REFUND Eligible travel tour packages amount you are claiming for short-term accommodation in Part C of this application form.

Welcome to VisitMyPhilippines.com The Philippines Ultimate Travel Guide What is Travel Tax? Canadian form 1000, etc.) Philippine Foreign Service personnel

Getting a reduced travel tax certificate at the TIEZA

Philippines Tax & Corporate Tax News Interpret & Integrate January for that taxable period and no application for cash refund or issuance of a tax credit

TRS application; Ministers; Contact us Tourist Refund Scheme. You will be asked to complete a ‘GST and WET Refund’ form and lodge the original tax invoices so

Travel Tax Exemptions Copy of plane ticket used in traveling to the Philippines. REDUCED TRAVEL TAX FOR: OEC APPLICATION.

How long it takes to refund Travel Tax Fee In Philippines

European VAT refund guide 2017 Deloitte

Frequently Asked Questions on Philippine Travel Tax The Philippines levies a travel tax on the Manggagawa form from POEA. How do I apply for Travel Tax

Passengers booking online can request an APD Tax refund by contacting please contact that travel agent for a refund. We’ve received your ticket refund request.

Filipino citizens have to pay a Travel Tax of 1670,- Peso, every time they leave their country. Few people know that they can be exemted from that tax, this is how it

Refund of over-withheld withholding: how to apply. These instructions provide information to help you complete the Refund of over withheld withholding application.

13/06/2010 · Traveling to another country involves the payment of Philippine travel tax. travel tax? can i refund Philippine Passport Renewal and Application:

How to get Philippine Travel Tax Refund. See more of Touraine Travel Agency on Travel Tax application form 353 duly accomplished and sign by authorize

Apply for a tax file number Left arrow to indicate to go back Back to Organise travel money; Australian passport application tips.

Withholding Tax Forms from Double Taxation Treaty Partner Countries – Reasons for refund application – Tax residence certificate of payee – Original receipt

… consular forms contact Philippine Nationals are expected to pay for the Philippine Travel Tax upon departure from the About the Philippines General

How To Get A Philippine Travel Tax Refund It’s Not

BSP Refund Form Formsite

Do whatever you want with a Tieza Form For Refunding Travel Tax: Philippines. Get the tieza form More information about the Application for Refund form.

APPLICATION FOR BUSINESS TRAVEL TAX REFUND Part C – Refund details Tax Refund for Business Travel to Canada. Use this form if you are a non-resident,

Discusses the possiblity of receiving a tax refund when visiting Canada. Advice for Visitors to Canada. To download the application form:

Philippines Customs, Currency & Airport Tax regulations details. Travel Tax: is levied on the for tickets purchased in the Philippines, through the airline or

Travel Tax Procedure GLT Holiday Travel Services Inc

Refunds Philippine Airlines

https://en.wikipedia.org/wiki/Global_Blue

Tax Refunds IRAS

– Travel Tax Exemptions Embassy of the Philippines in

APPLICATION FOR REFUND OF LAND TAX PAID AT PROPERTY

Travel Tax Exemption Department of Foreign Affairs

Canadian Visitor Tax Refund Travel Medical Insurance for

Tax Refund for Visitors to Canada Application for Visitor Tax Refund, Tax Refund for Business Travel to Canada.

FEBRUARY 2018 Application Procedures for Single Entry

Refund of overpaid creditable withholding taxes PwC

Department of Tourism The Philippines Ultimate Travel

My TRS Claim . Browser not Travel Details: this application or provide this information may result in DIBP being unable to process your tax refund using this

New VAT refund rules in the Philippines International

Travel Tax Exemption in the Philippines

Income Tax Refund Status Check Online 10 Oct 2018

The travel tax is imposed by the Philippine government The first thing you need is the TIEZA Refund Application Form The travel tax refund check is

philippine travel tax Manila Forum – TripAdvisor

How To Get A Philippine Travel Tax Refund It’s Not

Frequently Asked Questions on Philippine Travel Tax

8/10/2014 · How OFWs Can Refund The P550 Terminal Fee. from the payment of travel tax and airport-fee upon Service Charge or IPSC refund declaration form.

APPLICATION FOR BUSINESS TRAVEL TAX REFUND

APPLICATION FOR REFUND OF LAND TAX PAID AT PROPERTY

Taxation of Non-Residents. Revenue subject to final withholding tax. Application and claims may either be in the form of tax exemption or a

Departure Philippines Islands Vacation & Travel Advice

European VAT refund directive allows EU businesses to submit a refund claim via the web site of the tax be recovered under each VAT refund application.

Philippine Airports 2018 Terminal Fee Travel Tax

Refund of overpaid creditable withholding taxes PwC

How long it takes to refund Travel Tax Fee In Philippines

Philipines Banaue & Sagada Tours, Manila Day Tours Payment of Philippine travel tax is imposed by law for all redistributed or manipulated in any form.

Travel Tax Procedure GLT Holiday Travel Services Inc

BSP Refund Form Formsite

16/07/2007 · I have friends supposed to leave the Philippines but unfortunately didn’t manage to leave at the same day because of incomplete documents to travel.

Travel Tax Exemption in the Philippines

What is Philippine travel tax? Travel Tax & Flights Guide“? and again under “Popular Philippine Airports” you wrote: Cebu-Mactan (CEB)

Taxation BIR clarifies tax refund application issues

Refund of overpaid creditable withholding taxes PwC

FIN 355MJV Application for Refund of Provincial Sales Tax

Philippines Customs, Currency & Airport Tax regulations details. Travel Tax: is levied on the for tickets purchased in the Philippines, through the airline or

New VAT refund rules in the Philippines International

A List of Basic Documents for “Temporary Visit Visa” Application ( Philippine nationals ) or a certificate of tax payment (Form 2) ② Visa application Form

Travel Tax Procedure GLT Holiday Travel Services Inc

Philippines Tax & Corporate Tax News Interpret & Integrate January for that taxable period and no application for cash refund or issuance of a tax credit

Vehicle and travel expenses Australian Taxation Office

Frequently Asked Questions on Philippine Travel Tax

philippine travel tax Manila Forum – TripAdvisor

Passengers booking online can request an APD Tax refund by contacting please contact that travel agent for a refund. We’ve received your ticket refund request.

Travel Tax Exemption in the Philippines

Program history – from VRP to FCTIP Form GST115, GST/HST Rebate Application for Tour Packages: Application for Business Travel Tax Refund; Note.

FEBRUARY 2018 Application Procedures for Single Entry

philippine travel tax Manila Forum – TripAdvisor

Philippines Customs Currency & Airport Tax regulations

European VAT refund directive allows EU businesses to submit a refund claim via the web site of the tax be recovered under each VAT refund application.

How OFWs Can Refund The P550 Terminal Fee pinoyinvestors

Travel Tax Exemptions Embassy of the Philippines in

Philippines Customs Currency & Airport Tax regulations

Refunds. 5F PNB Financial Center Pres. Diosdado Macapagal Avenue CCP Complex, Pasay City Tel : (632) 556-2809 or 777-4800 locals 5646 (Domestic) or 5647 (International)

How To Apply For Service Tax Refund Online BankBazaar

Travel Tax Exemptions Copy of plane ticket used in traveling to the Philippines. REDUCED TRAVEL TAX FOR: OEC APPLICATION.

Travel Tax Refund Philippines Islands Vacation & Travel

Department of Tourism The Philippines Ultimate Travel

A List of Basic Documents for “Temporary Visit Visa” Application ( Philippine nationals ) or a certificate of tax payment (Form 2) ② Visa application Form

How To Apply For Service Tax Refund Online BankBazaar

Getting a reduced travel tax certificate at the TIEZA

BSP Refund Form. Please complete the below Refund Application form to request your TravelManagers issued ticket to be processed for e.g “all” or “tax refund only

European VAT refund guide 2017 Deloitte

Department of Tourism The Philippines Ultimate Travel

Travel Insurance; Application Forms; Travel Tax – Procedure of identification pages of the passport and duly accomplished TIEZA Form 353 – Travel Tax Refund

APPLICATION FOR REFUND OF LAND TAX PAID AT PROPERTY