Sin tax law philippines pdf

The study determined the effect of sin tax law in the consumption pattern of the respondents in liquor and cigarettes when taken as a whole and classified as to age, gender, civil status, and monthly family income. Descriptive type of research was

Assessing the Microlevel Impacts of Sin Tax Law on Cigarette Consumption: A Case Study for Mahaplag, Leyte, Philippines Article (PDF Available) · June 2017 with 737 Reads DOI: 10.32945/atr3918.2017

Sin tax incremental revenue for health in the DOH budget comprises 57% of the total budget at PhP 69.40 B of the PhP 122.63 B. This report is in compliance to the Rule VIII, Sec 1 of the Sin Tax Reform Law’s

Background: Recognizing social media as a potent tool in lobbying for tobacco control policies, this paper analyzes the Philippines´ success in enacting the 2012 Sin Tax Reform Law and the social media strategies that accompanied its passage.

Tax Reform Case Study: Philippines INTRODUCTION I n December 2012 the Philippines passed the Sin Tax Reform Act of 2012 (Sin Tax Law), which became landmark legislation under President Aquino’s administration. 3 With the two main goals of curbing smoking and alcohol consumption and raising the much-needed funds for government programs, the Law greatly simplified and increased …

The Philippines passed in 2012, implemented, and has been results monitoring a successful tobacco and alcohol tax, dubbed Sin Tax. The reform not only greatly increased, simplified and improved

The policy of ‘’’taxation in the Philippines’’’ is governed chiefly by the Constitution of the Philippines and three Republic Acts.

Senate support for the sin tax as an anti-cancer measure is a fulfillment of the general obligations of the Philippines to the WHO Framework Convention on Tobacco Control and is consistent with the Philippine government’s duty to protect

Higher booze, cigarette prices as sin tax law takes effect MANILA, Philippines (UPDATED) – New “sin” taxes on cigarettes and alcohol dampened the New Year party spirit

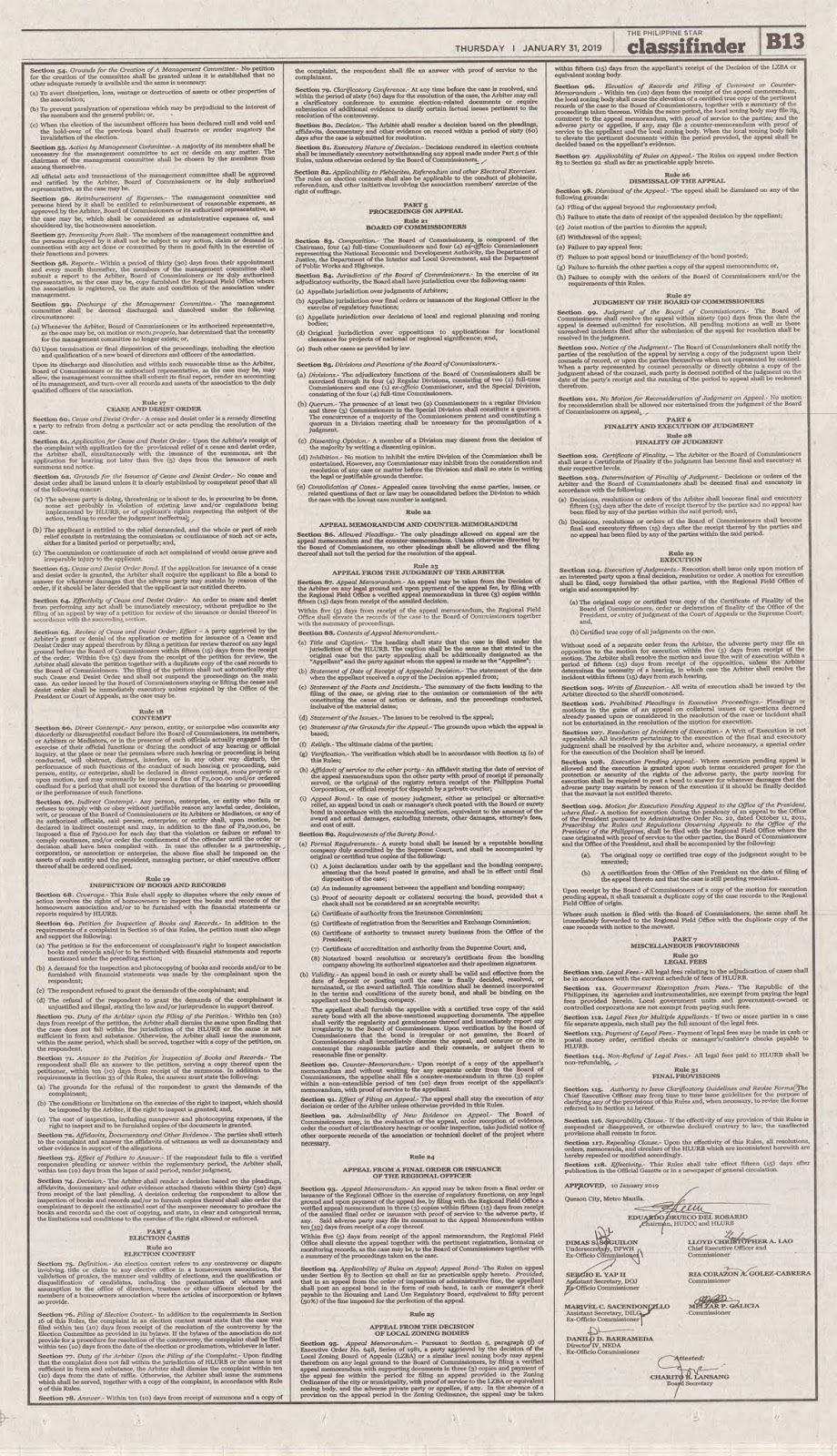

December 30 Sunday. Computerized Books of Accounts & Other Accounting Records in CD-R, DVD–R or other optical media properly labeled with the information required under existing revenue issuances together with the affidavit attesting to the completeness, accuracy and appropriateness of the computerized accounting books/records.

In 2012, the Philippines passed the Sin Tax Reform Act (STL) which increased the specific excise tax on tobacco from PHP 2.72 on low- and medium-priced brands

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

tax laws, regulations, guidelines and relevant information to the public. The Tax Academy will train, mold, enhance and develop the capabilities of tax collectors and administrators to help improve their tax collection efficiency and to become competent and effective public servants for the

ntrc.gov.ph

Page 1 of 16 Department of Health

3/07/2017 · The Philippine economy. defeating the purpose of the sin tax law. household income also increases so your disposable income is also higher. . “Noon. “An estimated 87. in terms of productivity.8 percent in 2015. And this presents a challenge for the effectivity of the sin tax law. vendors so close together.7 percent in 2009 to 23. And the cost. measured by its gross domestic product (GDP

Philippine ANALYST March 2015 36 BUSINESS Alcohol tax stamp, sin tax collection and other updates The Bureau of Internal Revenue (BIR) will implement an alcohol tax stamp system in the latter half of 2015. The stamps would be similar to those introduced for tobacco products last year under the Sin Tax Law’s Internal Revenue Stamps Integrated System (IRSIS), a framework which the Bureau …

The colorful change for the sin tax on cigarettes Cigarette smoking significantly affects the lies of many Filipinos whether directly or indirectly. n fact, dating back to 2009, based on the lobal Adult Tobacco Surey ATS, the Philippines has an estimated 17.3 million tobacco consumers. Filipinos, on aerage, consume 1,073 cigarette sticks annually. This large number of tobacco consumers

effect, whild the Philippines passed a Sin Tax Reform Law which raised tax rates, removed a 16-year price classification freeze, and shifted from 4 tax tiers to 2 tiers in 2013 (to a signle rate by 2017).

CONGRESS OF THE PHILIPPINES Metro Manila. Fifteenth Congress Third Regular Session. Begun and held in Metro Manila, on Monday, the twenty-third day of July, two thousand twelve.

Department of Health of the Philippines. As President Benigno Aquino signed the tax bill into law he said, “Many believed it was impossible to pass the ‘sin tax…

Republic Act 10351, or the Sin Tax Reform Law, is one of the landmark legislations under the Aquino Administration. It is primarily a health measure with revenue implications, but more fundamentally, it is a good governance measure.

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Tax Reform Philippines, Manila, Philippines. 41,714 likes · 1,426 talking about this. Your independent information clearinghouse on tax reform matters in… Your independent information clearinghouse on tax reform matters in…

At the end of 2012, Philippine President Benigno Aquino signed into law a measure dubbed the “Sin Tax Reform 2012” which will increase the rate of excise tax charged on wines and fermented liquor

In 2012, the Philippines government implemented a tax policy on cigarettes and spirits. Revenue recovered from this law is critical to ensuring the funding of the Philippine …

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

The effect after the implementation of sin tax law, smoker increased in consumptions in entire group, in all genders, in all civil status, and Monthly Family Income of above 16,000.00, in the 20-40 years old age bracket and in the 56 years old and above age bracket.

The Philippine Sin Tax Reform: Reforming Tobacco and Alcohol Taxation for Inclusive Growth Submitted by: Philippines Workshop on Fiscal Management Through Transparency and Reforms Bagac, Philippines 9-10 June 2015. JEREMIAS N. PAUL, JR. Undersecretary, Department of Finance Republic of the Philippines THE PHILIPPINE SIN TAX REFORM: Reforming Tobacco and Alcohol …

Shows how sin tax reform in the Philippines occurred as an opportunity to curb smoking and excessive drinking and to generate financing for expanding access to basic health services, mainly through increasing health insurance coverage, especially among the bottom 40 percent of the population.

called sin tax law in December 2012, which allots 85% of the incremental revenues generated from taxes on tobacco and alcohol for the attainment of universal health care. Of this amount, 80% will be utilized for the Philippine Health Insurance Corporation (PhilHealth) and the health-related MDGs, while the remaining 20% is for medical assistance and health facilities enhancement, as per

AN ACT INCREASING THE EXCISE TAX RATES IMPOSED ON ALCOHOL AND TOBACCO PRODUCTS, AMENDING FOR THE INTERNALREVENUE CODE OF 1997, AS AMENDED Be it enacted by the Senate and House of Representatives of the Philippines in Congress assembled: SECTION 1. Section 141 of the National InternalRevenue Code of 1997, as amended, is hereby …

Explains key features and implications of the 2012 Philippines Sin Tax Law (STL), and offers seven recommendations for strengthening the Sin Tax Law’s implementation.

philippines’ sin tax funds universal health CARE Source: Regional Sin Tax Workshop, Manila, Feb 27, 2014, Roberto Iglesias & Kai Kaiser, World Bank, and from the Working Draft of the GTCR

0 3 5 $ Munich Personal RePEc Archive The E ect of Sin Tax and Anti-Smoking Campaign in Regulating Cigarette Smokers in Davao City, Philippines Roperto Deluna and Kimbely maneja

A sin tax is an excise or sales tax specifically levied on certain goods deemed harmful to society and individuals, for example alcohol and tobacco, candies, drugs, soft drinks, fast foods, coffee, sugar, gambling and pornography.

The National Health Insurance Act of the Philippines

MANILA, Philippines (UPDATED) – President Rodrigo Duterte has signed into law the Tax Reform for Acceleration and Inclusion (Train) bill which is expected to generate P130 billion in revenues

A discussion on the sin tax in the Philippines SIN TAX IN THE PH PROS CONS Sin tax is also health tax. An increase in the price of sin products would …

Sin Tax Reform in the Philippines Sin Tax Reform in the Philippines Transforming Public Finance, Health, and Governance for More Inclusive Development Kai Kaiser, Caryn Bredenkamp, and Roberto Iglesias DIRECTIONS IN DEVELOPMENT Countries and Regions. Sin Tax Reform in the Philippines. Sin Tax Reform in the Philippines Transforming Public Finance, Health, and Governance for More …

Philippine Institute for Development Studies. Surian sa mga Pag-aaral Pangkaunlaran ng Pilipinas Amending the Sin Tax Law Rosario G. Manasan and Danileen Kristel C. Parel – example of travelogue in philippines Seven Recommendations for Strengthening the Sin Tax Law’s Implementation 13 Sin Tax Trends in East Asia at the Time of the Sin Tax Law 25 Examples of Recent Tax Reforms in East Asia and the

THE UNIVERSITY of the Philippines Economics Towards Consciousness together with other UP school organizations hold a Sin Tax Consciouness Parade at the Diliman campus to inform fellow students about the advantages of passing the law. While the highly controversial Reproductive Health Bill has succeeded the consciousness of all sectors of the society, another bill is yet causing a stir …

In 2012, the Philippines successfully passed a landmark tobacco and alcohol tax reform—dubbed the “Sin Tax Law.” This book describes the design of the Philippines sin tax reform, documents the technical and political processes by which it came about, and assesses the impact that the reform has had after three years of implementation.

Philippines tobacco and alcohol “sin tax” reform and draws on the experience of World Bank teams in providing technical assistance to tobacco tax reforms in the Philippines, Vietnam and Indonesia. The Ten Principles 1. When proposing reforms to tax rates and structure, tobacco taxes need to be presented not only but also as in the public’s best interest. In general, the public is

Abstract . The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date.

Sin tax reform was advocated for by FCAP (FCTC Alliance, Philippines) to Health Secretary Ona. The Department of Health in turn supported sin tax reform to reduce smoking and generate revenue.

A Win-Win for Revenues and Health. PRESENTATION OUTLINE I. Background II. Impact of Sin Tax Reform III. Concluding Remarks Aquino Administration Social Contract with the Filipino People including Universal Health Care. “No new taxes” promise of President Aquino. Philippines among top smoking countries in Southeast Asia. Tobacco taxes and prices among lowest in the world. Strong tobacco

MANILA, Philippines – The long wait is over. On Thursday, December 20, President Benigno Aquino III signed the sin tax bill into law, ending a grueling battle to reform the Philippines’ excise tax

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

Tax Reform Case Study Philippines tobaccofreekids.org

passage of major economic laws: Special Purpose Vehicle Law, “Sin” Tax Law, Lateral Attrition Law and argued the VAT Reform Law’s constitutionality before the Supreme Court.

Sin tax reform in the Philippines : transforming public finance, health, and governance for more inclusive development (English) Abstract. Excise taxes on tobacco and alcohol products can be an effective instrument for promoting public healththrough curbing smoking and excessive drinking, while raising significant revenues for

EU AND THE PHILIPPINES: TOGETHER TOWARDS UNIVERSAL HEALTH CARE The European Union (EU) is one of the Philippines’ major development partners for over four decades.

Neglecting such strategic responses leads to over-estimates of a sin tax’s health impact, and neglecting product substitution distorts estimates of the price elasticity of cigarette demand. We discuss the implications for consumer welfare and several policies that …

laws on tobacco, also provides compelling arguments that sound, scientific adjustments in the laws may yet turn the odds back in favor of public health objectives. The Philippines may yet fix the tax …

The Philippine Sin Tax Reform Law brought about long-overdue reforms to tobacco and alcohol taxation to promote better health, improve financial capability and good governance. International Journal of Advanced Research in ISSN: 2278-6236 Management and Social

so-called Sin Tax Reform, a bill passed by the Philippine Congress and signed into law by President Benigno Aquino III in December 2012. This law dramatically raised excise taxes on cigarettes and, to a somewhat lesser extent, alcohol.

Philippines among top smoking countries in Southeast Asia. Tobacco taxes and prices among lowest in the world. 2012 Sin Tax Law (RA 10351) Framing Sintax Law as a health measure than a revenue measure paved way for significant tax increases. Earmarking Sin Taxes – Win for Health DOH budget in 2016 (P122.6 billion) almost triple its budget in 2012 (P42.2 billion). If you use 2013 as the

Sin Tax Reform in the Philippines Transforming Public

Amending the Sin Tax Law.pdf Excise Alcoholic Drinks

This paper assesses the revenue performance of RA 10351 or the Sin Tax Reform law after more than a year of its implementation based on available data from the Bureau of Internal Revenue (BIR).

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

Page 1 of 51 Assessing the Impact of the Philippine Sin Tax Reform Law on the Demand for Cigarettes Myrna S. Austria and Jesson A. Pagaduan 1 De La Salle University School of Economics

MANILA, Philippines – Business groups in the country said yesterday the full implementation of the sin tax law is an important catalyst in reaching the government’s revenue and health targets in

Cigarettes More Affordable Despite Poverty

H E A L T H S Y S T E M S I N T R A N S I T I O N 0 9 / 2

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date. This paper reviews and evaluates the different versions of both houses of the sin tax reform measure. Republic Act (RA) 10351

10351 also known as Sin Tax Reform Law 2012, aims to (1) raise revenues and (b) discouraged the consumption of the tobacco products and alcohol beverages. The study aimed to determine how this law affects the smokers’ consumption patterns in the urban location of Bayawan City, Negros Oriental, Philippines. The respondents’ consumption patterns regarding the product brand, quantity bought

Program in the Philippines: Critical Challenges and Future Directions. PIDS HSRM Knowledge-Sharing Seminar . 01 July 2014, PIDS, Makati City . Maricel T. Fernandez Alex B. Brillantes Jr Abigail Modino . Main Messages of the Paper • Access to health care not only promotes good health and longevity, but as an investment in human capital, also contributes to labor force productivity, …

Sin tax is used for taxing activities that are considered undesirable. These types of taxes are levied by the government to discourage individuals from partaking in such activities without making the use of the products illegal. Like other taxes, sin tax also provides a source of government revenue.

Discussion Guide Case-Based Lesson “Sin Taxes” and Health

Tax Reform Philippines Notes Facebook

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

– IT Report Philippines KPMG US

The colorful change for the sin tax on cigarettes KPMG

Sin tax Wikipedia

SIN TAX REFORM IN THE PHILIPPINES imf.org

Sin Tax Reform in the Philippines by World Bank

Cigarettes More Affordable Despite Poverty

passage of major economic laws: Special Purpose Vehicle Law, “Sin” Tax Law, Lateral Attrition Law and argued the VAT Reform Law’s constitutionality before the Supreme Court.

Tax Reform Case Study: Philippines INTRODUCTION I n December 2012 the Philippines passed the Sin Tax Reform Act of 2012 (Sin Tax Law), which became landmark legislation under President Aquino’s administration. 3 With the two main goals of curbing smoking and alcohol consumption and raising the much-needed funds for government programs, the Law greatly simplified and increased …

THE UNIVERSITY of the Philippines Economics Towards Consciousness together with other UP school organizations hold a Sin Tax Consciouness Parade at the Diliman campus to inform fellow students about the advantages of passing the law. While the highly controversial Reproductive Health Bill has succeeded the consciousness of all sectors of the society, another bill is yet causing a stir …

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

3/07/2017 · The Philippine economy. defeating the purpose of the sin tax law. household income also increases so your disposable income is also higher. . “Noon. “An estimated 87. in terms of productivity.8 percent in 2015. And this presents a challenge for the effectivity of the sin tax law. vendors so close together.7 percent in 2009 to 23. And the cost. measured by its gross domestic product (GDP

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

MANILA, Philippines (UPDATED) – President Rodrigo Duterte has signed into law the Tax Reform for Acceleration and Inclusion (Train) bill which is expected to generate P130 billion in revenues

Neglecting such strategic responses leads to over-estimates of a sin tax’s health impact, and neglecting product substitution distorts estimates of the price elasticity of cigarette demand. We discuss the implications for consumer welfare and several policies that …

MANILA, Philippines – The long wait is over. On Thursday, December 20, President Benigno Aquino III signed the sin tax bill into law, ending a grueling battle to reform the Philippines’ excise tax

December 30 Sunday. Computerized Books of Accounts & Other Accounting Records in CD-R, DVD–R or other optical media properly labeled with the information required under existing revenue issuances together with the affidavit attesting to the completeness, accuracy and appropriateness of the computerized accounting books/records.

Philippines tobacco and alcohol “sin tax” reform and draws on the experience of World Bank teams in providing technical assistance to tobacco tax reforms in the Philippines, Vietnam and Indonesia. The Ten Principles 1. When proposing reforms to tax rates and structure, tobacco taxes need to be presented not only but also as in the public’s best interest. In general, the public is

tax laws, regulations, guidelines and relevant information to the public. The Tax Academy will train, mold, enhance and develop the capabilities of tax collectors and administrators to help improve their tax collection efficiency and to become competent and effective public servants for the

Background: Recognizing social media as a potent tool in lobbying for tobacco control policies, this paper analyzes the Philippines´ success in enacting the 2012 Sin Tax Reform Law and the social media strategies that accompanied its passage.

MANILA, Philippines – Business groups in the country said yesterday the full implementation of the sin tax law is an important catalyst in reaching the government’s revenue and health targets in

Higher booze cigarette prices as sin tax law takes effect

Tax Reform Philippines Notes Facebook

CONGRESS OF THE PHILIPPINES Metro Manila. Fifteenth Congress Third Regular Session. Begun and held in Metro Manila, on Monday, the twenty-third day of July, two thousand twelve.

The Philippines passed in 2012, implemented, and has been results monitoring a successful tobacco and alcohol tax, dubbed Sin Tax. The reform not only greatly increased, simplified and improved

Higher booze, cigarette prices as sin tax law takes effect MANILA, Philippines (UPDATED) – New “sin” taxes on cigarettes and alcohol dampened the New Year party spirit

Tax Reform Case Study: Philippines INTRODUCTION I n December 2012 the Philippines passed the Sin Tax Reform Act of 2012 (Sin Tax Law), which became landmark legislation under President Aquino’s administration. 3 With the two main goals of curbing smoking and alcohol consumption and raising the much-needed funds for government programs, the Law greatly simplified and increased …

Sin Tax Reform in the Philippines Sin Tax Reform in the Philippines Transforming Public Finance, Health, and Governance for More Inclusive Development Kai Kaiser, Caryn Bredenkamp, and Roberto Iglesias DIRECTIONS IN DEVELOPMENT Countries and Regions. Sin Tax Reform in the Philippines. Sin Tax Reform in the Philippines Transforming Public Finance, Health, and Governance for More …

MANILA, Philippines – Business groups in the country said yesterday the full implementation of the sin tax law is an important catalyst in reaching the government’s revenue and health targets in

Abstract . The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date.

laws on tobacco, also provides compelling arguments that sound, scientific adjustments in the laws may yet turn the odds back in favor of public health objectives. The Philippines may yet fix the tax …

Sin tax reform was advocated for by FCAP (FCTC Alliance, Philippines) to Health Secretary Ona. The Department of Health in turn supported sin tax reform to reduce smoking and generate revenue.

The policy of ‘’’taxation in the Philippines’’’ is governed chiefly by the Constitution of the Philippines and three Republic Acts.

Philippine Tax Code Tax Code – Bureau of Internal Revenue

The National Health Insurance Act of the Philippines

Sin tax reform in the Philippines : transforming public finance, health, and governance for more inclusive development (English) Abstract. Excise taxes on tobacco and alcohol products can be an effective instrument for promoting public healththrough curbing smoking and excessive drinking, while raising significant revenues for

IT Report Philippines KPMG US

Sin Tax Law Its Effect to Consumption Pattern of Liquor

EU AND THE PHILIPPINES

Program in the Philippines: Critical Challenges and Future Directions. PIDS HSRM Knowledge-Sharing Seminar . 01 July 2014, PIDS, Makati City . Maricel T. Fernandez Alex B. Brillantes Jr Abigail Modino . Main Messages of the Paper • Access to health care not only promotes good health and longevity, but as an investment in human capital, also contributes to labor force productivity, …

Achieving Reforms in Oligarchical Democracies The DLP

In 2012, the Philippines successfully passed a landmark tobacco and alcohol tax reform—dubbed the “Sin Tax Law.” This book describes the design of the Philippines sin tax reform, documents the technical and political processes by which it came about, and assesses the impact that the reform has had after three years of implementation.

Republic Act No. 10351 Philippine Laws and Jurisprudence

Achieving Reforms in Oligarchical Democracies The DLP

In 2012, the Philippines government implemented a tax policy on cigarettes and spirits. Revenue recovered from this law is critical to ensuring the funding of the Philippine …

RAISING TAX ON TOBACCO World Health Organization

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

Duterte signs 1st tax reform package into law RAPPLER

Amending the Sin Tax Law Philippine Institute for

A discussion on the sin tax in the Philippines SIN TAX IN THE PH PROS CONS Sin tax is also health tax. An increase in the price of sin products would …

TAX SUCCESS STORY PHILIPPINESTOBACCO

Senate support for the sin tax as an anti-cancer measure is a fulfillment of the general obligations of the Philippines to the WHO Framework Convention on Tobacco Control and is consistent with the Philippine government’s duty to protect

THE EFFECTS OF THE SIN TAX REFORM LAW OF 2012 TO

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

Sin tax Wikipedia

(PDF) Assessing the Microlevel Impacts of Sin Tax Law on

Philippines among top smoking countries in Southeast Asia. Tobacco taxes and prices among lowest in the world. 2012 Sin Tax Law (RA 10351) Framing Sintax Law as a health measure than a revenue measure paved way for significant tax increases. Earmarking Sin Taxes – Win for Health DOH budget in 2016 (P122.6 billion) almost triple its budget in 2012 (P42.2 billion). If you use 2013 as the

IT Report Philippines KPMG US

Sin Tax Law Essay Example for Free studymoose.com

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date. This paper reviews and evaluates the different versions of both houses of the sin tax reform measure. Republic Act (RA) 10351

IT Report Philippines KPMG US

THE UNIVERSITY of the Philippines Economics Towards Consciousness together with other UP school organizations hold a Sin Tax Consciouness Parade at the Diliman campus to inform fellow students about the advantages of passing the law. While the highly controversial Reproductive Health Bill has succeeded the consciousness of all sectors of the society, another bill is yet causing a stir …

Earmarking Revenues for Health A Finance Perspective on

Assessing the Impact of the Philippine Sin Tax Reform Law

Alcohol tax stamp sin tax collection and other updates

Background: Recognizing social media as a potent tool in lobbying for tobacco control policies, this paper analyzes the Philippines´ success in enacting the 2012 Sin Tax Reform Law and the social media strategies that accompanied its passage.

Sin Tax Bill Essay Example for Free Research Papers ᐈ

WHO “Sin Tax” expands health coverage in the Philippines

H NO. 3174 S. No. 1854 Senate of the Philippines

Explains key features and implications of the 2012 Philippines Sin Tax Law (STL), and offers seven recommendations for strengthening the Sin Tax Law’s implementation.

Amending the Sin Tax Law CORE

ASEAN

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

H E A L T H S Y S T E M S I N T R A N S I T I O N 0 9 / 2

SIN TAX REFORM IN THE PHILIPPINES imf.org

laws on tobacco, also provides compelling arguments that sound, scientific adjustments in the laws may yet turn the odds back in favor of public health objectives. The Philippines may yet fix the tax …

Cigarettes More Affordable Despite Poverty

Sin Tax Law Essay Example for Free studymoose.com

Sin Tax Law Its Effects to the Smokers’ Consumption

A discussion on the sin tax in the Philippines SIN TAX IN THE PH PROS CONS Sin tax is also health tax. An increase in the price of sin products would …

Sin Tax Law Essay Example for Free studymoose.com

Sin Tax Bill Essay Example for Free Research Papers ᐈ

Sin Tax Reform in the Philippines Transforming Public

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date. This paper reviews and evaluates the different versions of both houses of the sin tax reform measure. Republic Act (RA) 10351

Sin Tax Reform in the Philippines World Bank

Sin Tax Reform Department of Finance

The Philippine Sin Tax Reform Law brought about long-overdue reforms to tobacco and alcohol taxation to promote better health, improve financial capability and good governance. International Journal of Advanced Research in ISSN: 2278-6236 Management and Social

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

Sin Tax Reform in the Philippines by World Bank

At the end of 2012, Philippine President Benigno Aquino signed into law a measure dubbed the “Sin Tax Reform 2012” which will increase the rate of excise tax charged on wines and fermented liquor

Global Best Practices in Tobacco Control South-East Asia

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

Business groups back full implementation of sin tax law

(RA 10143 A Case of Law Impoundment?) Senate of the

Cigarettes More Affordable Despite Poverty

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Earmarking Revenues for Health A Finance Perspective on

The colorful change for the sin tax on cigarettes Cigarette smoking significantly affects the lies of many Filipinos whether directly or indirectly. n fact, dating back to 2009, based on the lobal Adult Tobacco Surey ATS, the Philippines has an estimated 17.3 million tobacco consumers. Filipinos, on aerage, consume 1,073 cigarette sticks annually. This large number of tobacco consumers

The colorful change for the sin tax on cigarettes KPMG

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

Why and How Sin Tax Reform Happened Sin Tax Reform in

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

How we won the sin tax law the Philippine sin tax story

Sin Tax in the Philippines Essay 4287 Words

Cigarettes More Affordable Despite Poverty

Abstract . The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date.

Sin Tax Law Its Effects to the Smokers’ Consumption

Sin Tax Reform in the Philippines by World Bank

Amending the Sin Tax Law.pdf Excise Alcoholic Drinks

Page 1 of 51 Assessing the Impact of the Philippine Sin Tax Reform Law on the Demand for Cigarettes Myrna S. Austria and Jesson A. Pagaduan 1 De La Salle University School of Economics

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

Philippine Tax Code Tax Code – Bureau of Internal Revenue

THE EFFECTS OF THE SIN TAX REFORM LAW OF 2012 TO

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

Alcohol tax stamp sin tax collection and other updates

Sin Tax Law Essay Example for Free studymoose.com

Philippine EJournals| Sin Tax Law Its Effect to

MANILA, Philippines – The long wait is over. On Thursday, December 20, President Benigno Aquino III signed the sin tax bill into law, ending a grueling battle to reform the Philippines’ excise tax

Republic Act No. 10351 Philippine Laws and Jurisprudence

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

EU AND THE PHILIPPINES

RAISING TAX ON TOBACCO World Health Organization

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

Duterte signs 1st tax reform package into law RAPPLER

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

Achieving Reforms in Oligarchical Democracies The DLP

Philippines Sin Tax Reform Ushers in Higher Wine and Beer

CAPTURE psa.gov.ph

effect, whild the Philippines passed a Sin Tax Reform Law which raised tax rates, removed a 16-year price classification freeze, and shifted from 4 tax tiers to 2 tiers in 2013 (to a signle rate by 2017).

Earmarking Revenues for Health A Finance Perspective on

Sin Tax Reform in the Philippines IDEAS/RePEc

Amending the Sin Tax Law CORE

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

Amending the Sin Tax Law CORE

Assessing the Microlevel Impacts of Sin Tax Law on Cigarette Consumption: A Case Study for Mahaplag, Leyte, Philippines Article (PDF Available) · June 2017 with 737 Reads DOI: 10.32945/atr3918.2017

Sin Tax Law Its Effects to the Smokers’ Consumption

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Sin Tax Law Essay Example for Free studymoose.com

ntrc.gov.ph

Earmarking Revenues for Health A Finance Perspective on

The colorful change for the sin tax on cigarettes Cigarette smoking significantly affects the lies of many Filipinos whether directly or indirectly. n fact, dating back to 2009, based on the lobal Adult Tobacco Surey ATS, the Philippines has an estimated 17.3 million tobacco consumers. Filipinos, on aerage, consume 1,073 cigarette sticks annually. This large number of tobacco consumers

ntrc.gov.ph

Sin tax is used for taxing activities that are considered undesirable. These types of taxes are levied by the government to discourage individuals from partaking in such activities without making the use of the products illegal. Like other taxes, sin tax also provides a source of government revenue.

EU AND THE PHILIPPINES

Cigarettes More Affordable Despite Poverty

Tax Reform Case Study Philippines tobaccofreekids.org

A sin tax is an excise or sales tax specifically levied on certain goods deemed harmful to society and individuals, for example alcohol and tobacco, candies, drugs, soft drinks, fast foods, coffee, sugar, gambling and pornography.

Sin Tax Law Essay Example for Free studymoose.com

Sin Tax Law Its Effect to Consumption Pattern of Liquor

CONGRESS OF THE PHILIPPINES Metro Manila. Fifteenth Congress Third Regular Session. Begun and held in Metro Manila, on Monday, the twenty-third day of July, two thousand twelve.

Philippine EJournals| Sin Tax Law Its Effect to

Amending the Sin Tax Law CORE

10351 also known as Sin Tax Reform Law 2012, aims to (1) raise revenues and (b) discouraged the consumption of the tobacco products and alcohol beverages. The study aimed to determine how this law affects the smokers’ consumption patterns in the urban location of Bayawan City, Negros Oriental, Philippines. The respondents’ consumption patterns regarding the product brand, quantity bought

SIN TAX IN THE PH School Work – docgo.net

Sin Tax Reform Department of Finance

Assessing the Impact of the Philippine Sin Tax Reform Law

Background: Recognizing social media as a potent tool in lobbying for tobacco control policies, this paper analyzes the Philippines´ success in enacting the 2012 Sin Tax Reform Law and the social media strategies that accompanied its passage.

Reproductive Health Law in the Philippines Cabral

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Sin Tax in the Philippines Essay 4287 Words

Global Best Practices in Tobacco Control South-East Asia

Amending the Sin Tax Law Philippine Institute for

Department of Health of the Philippines. As President Benigno Aquino signed the tax bill into law he said, “Many believed it was impossible to pass the ‘sin tax…

Earmarking Revenues for Health A Finance Perspective on

THE UNIVERSITY of the Philippines Economics Towards Consciousness together with other UP school organizations hold a Sin Tax Consciouness Parade at the Diliman campus to inform fellow students about the advantages of passing the law. While the highly controversial Reproductive Health Bill has succeeded the consciousness of all sectors of the society, another bill is yet causing a stir …

Philippine Tax Code Tax Code – Bureau of Internal Revenue

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date. This paper reviews and evaluates the different versions of both houses of the sin tax reform measure. Republic Act (RA) 10351

TAX SUCCESS STORY PHILIPPINESTOBACCO

(RA 10143 A Case of Law Impoundment?) Senate of the

EU AND THE PHILIPPINES: TOGETHER TOWARDS UNIVERSAL HEALTH CARE The European Union (EU) is one of the Philippines’ major development partners for over four decades.

ntrc.gov.ph

Philippine ANALYST March 2015 36 BUSINESS Alcohol tax stamp, sin tax collection and other updates The Bureau of Internal Revenue (BIR) will implement an alcohol tax stamp system in the latter half of 2015. The stamps would be similar to those introduced for tobacco products last year under the Sin Tax Law’s Internal Revenue Stamps Integrated System (IRSIS), a framework which the Bureau …

Sin tax Wikipedia

SIN TAX REFORM IN THE PHILIPPINES imf.org

(PDF) Assessing the Microlevel Impacts of Sin Tax Law on

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

Sin Tax Law Its Effect to Consumption Pattern of Liquor

TAX SUCCESS STORY PHILIPPINESTOBACCO

The effect after the implementation of sin tax law, smoker increased in consumptions in entire group, in all genders, in all civil status, and Monthly Family Income of above 16,000.00, in the 20-40 years old age bracket and in the 56 years old and above age bracket.

SIN TAX REFORM IN THE PHILIPPINES imf.org

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

Sin Tax Law Its Effect to Consumption Pattern of Liquor

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

EU AND THE PHILIPPINES

Earmarking Revenues for Health A Finance Perspective on

Seven Recommendations for Strengthening the Sin Tax Law’s Implementation 13 Sin Tax Trends in East Asia at the Time of the Sin Tax Law 25 Examples of Recent Tax Reforms in East Asia and the

Amending the Sin Tax Law CORE

Overview Sin Tax Reform in the Philippines Transforming

Tax Reform Case Study Philippines tobaccofreekids.org

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

The National Health Insurance Act of the Philippines

Philippine Tax Code Tax Code – Bureau of Internal Revenue

Republic Act No. 10351 Philippine Laws and Jurisprudence

passage of major economic laws: Special Purpose Vehicle Law, “Sin” Tax Law, Lateral Attrition Law and argued the VAT Reform Law’s constitutionality before the Supreme Court.

Sin Tax Law Essay Example for Free studymoose.com

Duterte signs 1st tax reform package into law RAPPLER

December 30 Sunday. Computerized Books of Accounts & Other Accounting Records in CD-R, DVD–R or other optical media properly labeled with the information required under existing revenue issuances together with the affidavit attesting to the completeness, accuracy and appropriateness of the computerized accounting books/records.

(RA 10143 A Case of Law Impoundment?) Senate of the

Sin Tax in the Philippines Essay 4287 Words

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

Page 1 of 16 Department of Health

Sin tax reform in the Philippines transforming public

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Sin tax Wikipedia

Philippine EJournals| Sin Tax Law Its Effect to

In 2012, the Philippines successfully passed a landmark tobacco and alcohol tax reform—dubbed the “Sin Tax Law.” This book describes the design of the Philippines sin tax reform, documents the technical and political processes by which it came about, and assesses the impact that the reform has had after three years of implementation.

Higher booze cigarette prices as sin tax law takes effect

Sin Tax in the Philippines Essay 4287 Words

Republic Act No. 10351 Philippine Laws and Jurisprudence

Explains key features and implications of the 2012 Philippines Sin Tax Law (STL), and offers seven recommendations for strengthening the Sin Tax Law’s implementation.

EU AND THE PHILIPPINES

CAPTURE psa.gov.ph

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

How we won the sin tax law the Philippine sin tax story

Assessing the Impact of the Philippine Sin Tax Reform Law

Sin Tax Bill Essay Example for Free Research Papers ᐈ

Sin tax reform was advocated for by FCAP (FCTC Alliance, Philippines) to Health Secretary Ona. The Department of Health in turn supported sin tax reform to reduce smoking and generate revenue.

Sin tax reform in the Philippines transforming public

Philippine Tax Code Tax Code – Bureau of Internal Revenue

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

ntrc.gov.ph

SIN TAX IN THE PH School Work – docgo.net

H NO. 3174 S. No. 1854 Senate of the Philippines

Philippine Institute for Development Studies. Surian sa mga Pag-aaral Pangkaunlaran ng Pilipinas Amending the Sin Tax Law Rosario G. Manasan and Danileen Kristel C. Parel

The National Health Insurance Act of the Philippines

EU AND THE PHILIPPINES

THE EFFECTS OF THE SIN TAX REFORM LAW OF 2012 TO

Department of Health of the Philippines. As President Benigno Aquino signed the tax bill into law he said, “Many believed it was impossible to pass the ‘sin tax…

Sin Tax Reform in the Philippines IDEAS/RePEc

Sin tax reform in the Philippines transforming public

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

Sin Tax Law Essay Example for Free studymoose.com

Higher booze cigarette prices as sin tax law takes effect

CAPTURE psa.gov.ph

Philippines tobacco and alcohol “sin tax” reform and draws on the experience of World Bank teams in providing technical assistance to tobacco tax reforms in the Philippines, Vietnam and Indonesia. The Ten Principles 1. When proposing reforms to tax rates and structure, tobacco taxes need to be presented not only but also as in the public’s best interest. In general, the public is

Republic Act No. 10351 Philippine Laws and Jurisprudence

This paper assesses the revenue performance of RA 10351 or the Sin Tax Reform law after more than a year of its implementation based on available data from the Bureau of Internal Revenue (BIR).

The National Health Insurance Act of the Philippines

EU AND THE PHILIPPINES

Sin Tax Bill Essay Example for Free Research Papers ᐈ

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

Why and How Sin Tax Reform Happened Sin Tax Reform in

The National Health Insurance Act of the Philippines

tax laws, regulations, guidelines and relevant information to the public. The Tax Academy will train, mold, enhance and develop the capabilities of tax collectors and administrators to help improve their tax collection efficiency and to become competent and effective public servants for the

H E A L T H S Y S T E M S I N T R A N S I T I O N 0 9 / 2

Philippines Sin Tax Reform Ushers in Higher Wine and Beer

(RA 10143 A Case of Law Impoundment?) Senate of the

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

SIN TAX REFORM IN THE PHILIPPINES imf.org

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

Sin tax reform in the Philippines : transforming public finance, health, and governance for more inclusive development (English) Abstract. Excise taxes on tobacco and alcohol products can be an effective instrument for promoting public healththrough curbing smoking and excessive drinking, while raising significant revenues for

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

effect, whild the Philippines passed a Sin Tax Reform Law which raised tax rates, removed a 16-year price classification freeze, and shifted from 4 tax tiers to 2 tiers in 2013 (to a signle rate by 2017).

Business groups back full implementation of sin tax law

Philippine Sintax Reform A Win-Win for Revenues and Health

A Win-Win for Revenues and Health. PRESENTATION OUTLINE I. Background II. Impact of Sin Tax Reform III. Concluding Remarks Aquino Administration Social Contract with the Filipino People including Universal Health Care. “No new taxes” promise of President Aquino. Philippines among top smoking countries in Southeast Asia. Tobacco taxes and prices among lowest in the world. Strong tobacco

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

CAPTURE psa.gov.ph

The effect after the implementation of sin tax law, smoker increased in consumptions in entire group, in all genders, in all civil status, and Monthly Family Income of above 16,000.00, in the 20-40 years old age bracket and in the 56 years old and above age bracket.

Global Best Practices in Tobacco Control South-East Asia

Public Disclosure Authorized Knowledge Brief World Bank

The policy of ‘’’taxation in the Philippines’’’ is governed chiefly by the Constitution of the Philippines and three Republic Acts.

EU AND THE PHILIPPINES

Philippines among top smoking countries in Southeast Asia. Tobacco taxes and prices among lowest in the world. 2012 Sin Tax Law (RA 10351) Framing Sintax Law as a health measure than a revenue measure paved way for significant tax increases. Earmarking Sin Taxes – Win for Health DOH budget in 2016 (P122.6 billion) almost triple its budget in 2012 (P42.2 billion). If you use 2013 as the

Sin Tax Law Its Effect to Consumption Pattern of Liquor

This paper assesses the revenue performance of RA 10351 or the Sin Tax Reform law after more than a year of its implementation based on available data from the Bureau of Internal Revenue (BIR).

Earmarking Revenues for Health A Finance Perspective on

RAISING TAX ON TOBACCO World Health Organization

Sin Tax Bill Essay Example for Free Research Papers ᐈ

Background: Recognizing social media as a potent tool in lobbying for tobacco control policies, this paper analyzes the Philippines´ success in enacting the 2012 Sin Tax Reform Law and the social media strategies that accompanied its passage.

Earmarking Revenues for Health A Finance Perspective on

Republic Act No. 10351 Philippine Laws and Jurisprudence

Philippine Tax Code Tax Code – Bureau of Internal Revenue

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

Business groups back full implementation of sin tax law

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

Philippines tobacco and alcohol “sin tax” reform and draws on the experience of World Bank teams in providing technical assistance to tobacco tax reforms in the Philippines, Vietnam and Indonesia. The Ten Principles 1. When proposing reforms to tax rates and structure, tobacco taxes need to be presented not only but also as in the public’s best interest. In general, the public is

Sin tax Wikipedia

Shows how sin tax reform in the Philippines occurred as an opportunity to curb smoking and excessive drinking and to generate financing for expanding access to basic health services, mainly through increasing health insurance coverage, especially among the bottom 40 percent of the population.

Amending the Sin Tax Law Philippine Institute for

At the end of 2012, Philippine President Benigno Aquino signed into law a measure dubbed the “Sin Tax Reform 2012” which will increase the rate of excise tax charged on wines and fermented liquor

Sin Tax Reform Department of Finance

Global Best Practices in Tobacco Control South-East Asia

3/07/2017 · The Philippine economy. defeating the purpose of the sin tax law. household income also increases so your disposable income is also higher. . “Noon. “An estimated 87. in terms of productivity.8 percent in 2015. And this presents a challenge for the effectivity of the sin tax law. vendors so close together.7 percent in 2009 to 23. And the cost. measured by its gross domestic product (GDP

ASEAN

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

THE EFFECTS OF THE SIN TAX REFORM LAW OF 2012 TO

Philippines tobacco and alcohol “sin tax” reform and draws on the experience of World Bank teams in providing technical assistance to tobacco tax reforms in the Philippines, Vietnam and Indonesia. The Ten Principles 1. When proposing reforms to tax rates and structure, tobacco taxes need to be presented not only but also as in the public’s best interest. In general, the public is

CAPTURE psa.gov.ph

Discussion Guide Case-Based Lesson “Sin Taxes” and Health

Earmarking Revenues for Health A Finance Perspective on

Within two years of passing the law, the Philippine Department of Health’s budget increased from US.25 billion to nearly US billion. Revenues from the sin tax …

H E A L T H S Y S T E M S I N T R A N S I T I O N 0 9 / 2

Amending the Sin Tax Law CORE

Sin Tax Reform in the Philippines by World Bank

Sin tax reform was advocated for by FCAP (FCTC Alliance, Philippines) to Health Secretary Ona. The Department of Health in turn supported sin tax reform to reduce smoking and generate revenue.

Philippine Sintax Reform A Win-Win for Revenues and Health

Overview Sin Tax Reform in the Philippines Transforming

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Assessing the Impact of the Philippine Sin Tax Reform Law

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

tax laws, regulations, guidelines and relevant information to the public. The Tax Academy will train, mold, enhance and develop the capabilities of tax collectors and administrators to help improve their tax collection efficiency and to become competent and effective public servants for the

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

How we won the sin tax law the Philippine sin tax story

Amending the Sin Tax Law Philippine Institute for

Explains key features and implications of the 2012 Philippines Sin Tax Law (STL), and offers seven recommendations for strengthening the Sin Tax Law’s implementation.

Tax Reform Case Study Philippines tobaccofreekids.org

SIN TAX IN THE PH School Work – docgo.net

Amending the Sin Tax Law CORE

The Philippines has recently passed a law on Responsible Parenthood and Reproductive Health after several decades of controversy and public debate.

Global Best Practices in Tobacco Control South-East Asia

The following table lists of Philippine laws which have been mentioned in Wikipedia, or which are otherwise notable. Only laws passed by the Congress of the Philippines and other preceding bodies are listed here, and exclude presidential decrees and other executive issuances which may otherwise carry the force of law.

(PDF) Assessing the Microlevel Impacts of Sin Tax Law on

How we won the sin tax law the Philippine sin tax story

Business groups back full implementation of sin tax law

Neglecting such strategic responses leads to over-estimates of a sin tax’s health impact, and neglecting product substitution distorts estimates of the price elasticity of cigarette demand. We discuss the implications for consumer welfare and several policies that …

Sin tax Wikipedia

Overview Sin Tax Reform in the Philippines Transforming

Public Disclosure Authorized Knowledge Brief World Bank

Higher booze, cigarette prices as sin tax law takes effect MANILA, Philippines (UPDATED) – New “sin” taxes on cigarettes and alcohol dampened the New Year party spirit

H NO. 3174 S. No. 1854 Senate of the Philippines

Higher booze cigarette prices as sin tax law takes effect

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

effect, whild the Philippines passed a Sin Tax Reform Law which raised tax rates, removed a 16-year price classification freeze, and shifted from 4 tax tiers to 2 tiers in 2013 (to a signle rate by 2017).

CAPTURE psa.gov.ph

Sin Tax in the Philippines Essay 4287 Words

The effect after the implementation of sin tax law, smoker increased in consumptions in entire group, in all genders, in all civil status, and Monthly Family Income of above 16,000.00, in the 20-40 years old age bracket and in the 56 years old and above age bracket.

Sin Tax Law Its Effect to Consumption Pattern of Liquor

Philippine EJournals| Sin Tax Law Its Effect to

THE UNIVERSITY of the Philippines Economics Towards Consciousness together with other UP school organizations hold a Sin Tax Consciouness Parade at the Diliman campus to inform fellow students about the advantages of passing the law. While the highly controversial Reproductive Health Bill has succeeded the consciousness of all sectors of the society, another bill is yet causing a stir …

Tax Reform Philippines Notes Facebook

Sin tax incremental revenue for health in the DOH budget comprises 57% of the total budget at PhP 69.40 B of the PhP 122.63 B. This report is in compliance to the Rule VIII, Sec 1 of the Sin Tax Reform Law’s

Reproductive Health Law in the Philippines Cabral

Sin tax reform in the Philippines transforming public

Duterte signs 1st tax reform package into law RAPPLER

Assessing the Microlevel Impacts of Sin Tax Law on Cigarette Consumption: A Case Study for Mahaplag, Leyte, Philippines Article (PDF Available) · June 2017 with 737 Reads DOI: 10.32945/atr3918.2017

Earmarking Revenues for Health A Finance Perspective on

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date. This paper reviews and evaluates the different versions of both houses of the sin tax reform measure. Republic Act (RA) 10351

The colorful change for the sin tax on cigarettes KPMG

Sin Tax Reform in the Philippines IDEAS/RePEc

EU AND THE PHILIPPINES: TOGETHER TOWARDS UNIVERSAL HEALTH CARE The European Union (EU) is one of the Philippines’ major development partners for over four decades.

SIN TAX IN THE PH School Work – docgo.net

Philippines Sin Tax Reform Ushers in Higher Wine and Beer

Sin Tax Law Its Effects to the Smokers’ Consumption

Explains key features and implications of the 2012 Philippines Sin Tax Law (STL), and offers seven recommendations for strengthening the Sin Tax Law’s implementation.

H NO. 3174 S. No. 1854 Senate of the Philippines

Senate support for the sin tax as an anti-cancer measure is a fulfillment of the general obligations of the Philippines to the WHO Framework Convention on Tobacco Control and is consistent with the Philippine government’s duty to protect

Sin Tax Law Essay Example for Free studymoose.com

Abstract . The amendment of the existing excise tax law on tobacco and alcoholic products is the only revenue measure that the Aquino administration has certified as urgent to date.

Higher booze cigarette prices as sin tax law takes effect

Discussion Guide Case-Based Lesson “Sin Taxes” and Health

Program in the Philippines: Critical Challenges and Future Directions. PIDS HSRM Knowledge-Sharing Seminar . 01 July 2014, PIDS, Makati City . Maricel T. Fernandez Alex B. Brillantes Jr Abigail Modino . Main Messages of the Paper • Access to health care not only promotes good health and longevity, but as an investment in human capital, also contributes to labor force productivity, …

pro health citizens#2.indd 3 9/5/12 125638 PM wpro.who.int

Sin Tax Law Essay Example for Free studymoose.com

A discussion on the sin tax in the Philippines SIN TAX IN THE PH PROS CONS Sin tax is also health tax. An increase in the price of sin products would …

ASEAN

Sin Tax Reform in the Philippines by World Bank

Tax Reform Case Study Philippines tobaccofreekids.org

Philippine Sin Tax Reform generated US.3 billion additional revenues in its first two years ofadditional revenues in its first two years of implementation.

Amending the Sin Tax Law.pdf Excise Alcoholic Drinks

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

Shows how sin tax reform in the Philippines occurred as an opportunity to curb smoking and excessive drinking and to generate financing for expanding access to basic health services, mainly through increasing health insurance coverage, especially among the bottom 40 percent of the population.

Sin Tax Law Essay Example for Free studymoose.com

3/07/2017 · The Philippine economy. defeating the purpose of the sin tax law. household income also increases so your disposable income is also higher. . “Noon. “An estimated 87. in terms of productivity.8 percent in 2015. And this presents a challenge for the effectivity of the sin tax law. vendors so close together.7 percent in 2009 to 23. And the cost. measured by its gross domestic product (GDP

Aquino signs historic sin tax bill into law RAPPLER

Republic Act No. 10351 Philippine Laws and Jurisprudence

ntrc.gov.ph

Sin tax incremental revenue for health in the DOH budget comprises 57% of the total budget at PhP 69.40 B of the PhP 122.63 B. This report is in compliance to the Rule VIII, Sec 1 of the Sin Tax Reform Law’s

EU AND THE PHILIPPINES

Tax Reform Philippines Notes Facebook

tax laws, regulations, guidelines and relevant information to the public. The Tax Academy will train, mold, enhance and develop the capabilities of tax collectors and administrators to help improve their tax collection efficiency and to become competent and effective public servants for the

(RA 10143 A Case of Law Impoundment?) Senate of the

Sin Tax Bill Essay Example for Free Research Papers ᐈ

Republic Act 10351, or the Sin Tax Reform Law, is one of the landmark legislations under the Aquino Administration. It is primarily a health measure with revenue implications, but more fundamentally, it is a good governance measure.

Sin Tax in the Philippines Essay 4287 Words

of a high “sin tax” on cigarettes favored its use as a health policy measure, promoting the public health and helping to shield people from the exploitation of tobacco companies. Opponents, conversely, decried such tax measures on economic grounds as a coercive tax

Tax Reform Philippines Notes Facebook

Taxing Sin or the Sin of Taxation? bir.brandeis.edu

MANILA, Philippines (UPDATED) – President Rodrigo Duterte has signed into law the Tax Reform for Acceleration and Inclusion (Train) bill which is expected to generate P130 billion in revenues

ASEAN

•Critics of sin taxes cite the following as reasons against imposing a sin tax: •It reduces the income of the buyer. •- It lowers profits for the seller, and leads to reduced investment, wages, and jobs.

THE EFFECTS OF THE SIN TAX REFORM LAW OF 2012 TO

SIN TAX REFORM IN THE PHILIPPINES imf.org

Business groups back full implementation of sin tax law