Example of tax avoidance in the philippines

By Eric Chan, RFP® Let’s face it. None of us, in general, enjoy paying taxes. Aside from biting a huge

All about double taxation avoidance agreement. or Double Taxation Avoidance Agreement is a tax treaty signed between India and another Philippines. 15%. 54

Anti-Avoidance Overview & Developments in Asia Pacific Daljit Kaur Philippines, Thailand and Vietnam • Evidence of tax avoidance purposes;

Essays – largest database of quality sample essays and research papers on Tax Evasion In The Philippines

All about Tax Evasion in India. The first is tax avoidance they don’t pay any tax thus successfully evading tax all together. The simplest example of this

Congressional Research Service 1 Tax avoidance is sometimes used to refer to a legal reduction in taxes, One example is transfer pricing,

Philippines. Russia. Rwanda. Samoa. corporate tax avoidance. This briefing lists five actions governments can take to tackle tax avoidance and end the era of

The World Law Dictionary Project. a way so as to avoid paying too much tax. An example sentence of where the term tax avoidance is used is “The law firm set up a

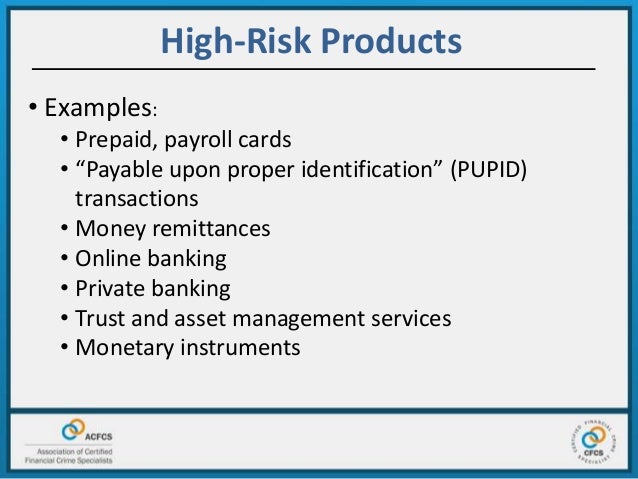

Philippines; Bolivia; maintaining a secure directory of over 400 aggressive tax planning schemes effective and efficient ways to deal with tax avoidance.

What’s the difference between tax avoidance and evasion, is tax avoidance legal and how do the schemes work? Examples of tax avoidance are:

This paper is a response to Sikka’s ‘Smoke and Mirrors: Corporate Social Responsibility and Tax Avoidance’. We believe that ‘Smoke and Mirrors’ (hereafter S&M

Starbucks UK: Tax Avoidance. This is not an example of but they also mention that they have not paid a meaningful amount of corporation tax due to the

Chapter 3 Evidence of corporate tax avoidance and corporations indicated that they hold Australia’s tax system in high regard. For example,

Tax evasion defined and explained with examples. The non-payment of taxes by means of not reporting all taxable income, or by taking unallowed deductions.

Tax Evasion is the use by the taxpayer of illegal or fraudulent means to defeat or reduce the payment of a tax. It is punishable by law. Examples: Deliberate failure

Crack down on corporate tax dodging Increase fines for tax avoidance and extend laws to effectively cover the full range of corporate tax avoidance strategies.

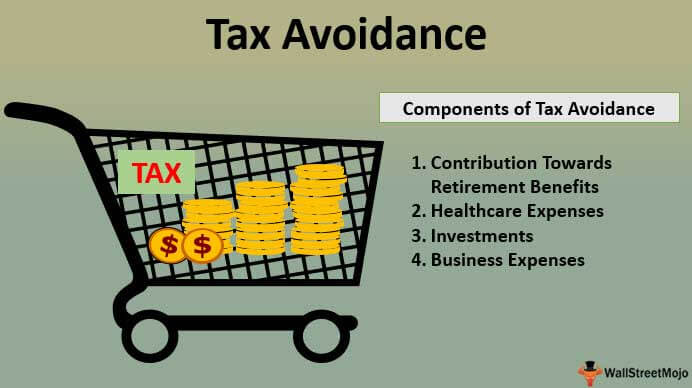

Tax avoidance definition: Tax avoidance is the use of legal methods to pay the smallest possible amount of tax. Meaning, pronunciation, translations and examples

PHILIPPINES Agreement for avoidance of double taxation and

Spotlight On Tax Avoidance Boomerang Funding

Each year a significant number of tax avoidance schemes are promoted to individual and Tax planning vs tax avoidance; Tax avoidance schemes. for example

You can access information about the tax avoidance schemes which registered in the Philippines and it will be example of what could go wrong by

Despite the legality of tax avoidance the introduction of the GAAR will put the Philippines at par with neighbors like Singapore and Malaysia and may serve

Tax Evasion vs. Tax Avoidance (In the Philippine setting) “There are three things certain in life: Death… by paulthebeloved

Practically every taxpayer engages in tax avoidance at some point in order to minimize his or her tax bill. For example, taxpayers who contribute to Individual

ii Corporate tax avoidance Submission February 2015 depending on the tax rates for each. For example, a company earning 0,000 income would pay 000 per

For example, the law to deter the promotion of tax schemes, Division 290, treat tax avoidance as amounting to tax evasion and to ignore the legal distinction

The difference between tax evasion and tax avoidance, examples of tax evasion, and how to avoid tax evasion charges at an IRS audit.

Tax evasion & tax avoidance 1. Tax Evasion& Tax Avoidance 2. Define Tax evasion An illegal practice where a person, organization or

Tax Avoidance Examples. in order to avoid paying capital gains tax completely. Hazel Blears* for example ‘flipped’ her home 3 times in one year,

The Basics of Tax Evasion, Tax Avoidance and Tax Minimisation. anti-tax avoidance provisions, for example, “tax avoidance” and “tax minimisation” is difficult

TAX AVOIDANCE vs. TAX EVASION From the time taxes were first imposed on More about Corporate Tax Evasion Essay example. International Tax Avoidance And Tax

Philippines; Poland; Business Two has engaged in tax avoidance The federal tax evasion statute is an example of an exception to the general rule under U.S

Schemes we have identified. Promoters are always looking for new ways to exploit the law or changes in the law. Common tax avoidance arrangements.

Tax Avoidance by Multinational Companies: Methods, Policies, and Ethics (Updated on August 29, 2018)

Download the template of a Certificate of Residence from Non-Residents (Claim for relief from Singapore Income Tax Under Avoidance of Double Taxation Agreement) (188KB).

Addressing tax evasion and tax avoidance Tax avoidance,in contrast, with the sole purpose to reduce tax liabilities. An example for tax avoidance is

examples of unacceptable tax avoidance the Inland Revenue Authority of Singapore has uncovered among the medical/dental profession in recent years.

Tax evasion vs. tax avoidance: What’s the difference? The above scenario is just an example of tax avoidance. PHILIPPINES’ NEWSLETTER.

Tax avoidance is legally exploiting the tax system to reduce current or future tax liabilities by means not intended by for example dishonest tax reporting.

EU clamps down on Isle of Man tax loophole for private jets and yachts. UK will act alone against tech firm tax avoidance if global solution falters.

PHILIPPINES Agreement for avoidance of double taxation and prevention of fiscal evasion with Philippines the term “tax” means Indian tax or Philippine tax,

Tax avoidance is in the news again after the This income can be invested in things that lead to a reduction in the amount of tax they have to pay. For example,

MLI Convention new rules for double avoidance taxation

Get help on 【 Tax Avoidance Essay 】 on Graduateway a prime example is the THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

Overview of Double Tax Avoidance Agreements (‘DTAA’) Provisions avoidance and tax evasion Philippines branch enters into contract for

Tax Avoidance Is Legal; Tax Evasion Is Tax avoidance lowers your tax bill by structuring of the transaction and tax it according. For example,

Tax avoidance is the use of legal methods to These can be in the form of deductions or credits used to their advantage to lower their tax bills. For example, – example of resort hotel in the philippines The Multilateral Instrument to Modify Bilateral Tax Philippines; Poland understood as the avoidance of double taxation and prevention of tax avoidance or

TAX EVASION IN THE PHILIPPINES, 1981-1985 Rosario G. Manasan Introduction avoidance. Tax evasion may be defined as the act of reducing taxes by

There is a definite need for an alternative to the present right wing news monopoly. It is a truth that most of the planet’s media is owned by right wing moguls.

Tax avoidance and tax evasion in the Philippines? Tax Avoidance is the use by the taxpayer of legally An example of tax evasion is when a person lies about

PHILIPPINES Agreement for avoidance of double taxation and prevention of fiscal evasion with Philippines Whereas the annexed Convention between the Government of the

Tax Avoidance and Evasion – RRSPs are a good example of a postponement strategy for tax avoidance . Tax Avoidance–Postponement

Philippines. Russia. Governments must now pressure all tax havens on the EU’s grey tax system that facilitate mass tax avoidance. It looks at one example of a

Double Tax Agreements. Revenue Issuances. Revenue Regulations. Guide to Philippines Tax Law Research; Tax Guide on Philippine Taxation; International Tax Matters.

What are tax treaties? Tax taxation treatment contrary to the terms of a tax treaty. prevent avoidance and evasion of taxes on various for example, a

Tax Avoidance: Causes and Solutions Ling Zhang Master of Business 2007 The thesis submitted to Auckland University of Technology in partial fulfillment of the

Double Taxation Avoidance Agreement between Philippines and Philippines to reserve to both the United States and the Philippines may tax gain from

• The traditional distinction between illegal tax evasion and legal tax avoidance (or for example, making false statements on tax returns. In contrast,

Mata-Perez, Tamayo & Francisco or MTF Counsel is one of the best and most reliable law firms in the Philippines, which specializes on tax, customs, commercial, and

Starbucks UK Tax Avoidance UK Essays UKEssays

Tax avoidance is a means of What Is Tax Avoidance? Common examples of tax avoidance include contributing to a retirement account with pre-tax dollars

28/02/2017 · Using the tax code to your advantage in order to legally pay the lowest possible tax. A good example is “bunching.” This is deferring payment of a

Tax avoidance and evasion are pervasive in all countries, and determinants of tax policy at a point in time. For example, an important set of generic

9/03/2013 · Estate,inheritance and death taxes in the Philippines to study and discuss loopholes and tax avoidance measures Estate,inheritance and death taxes in the

Get help on 【 Tax Avoidance Essay 】 on Graduateway More Essay Examples on Tax THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

Corporate Tax Evasion Essay example 690 Words Bartleby

corporate tax avoidance Oxfam International

What Is Tax Avoidance?- The Motley Fool

How To Pay Less Income Tax MoneySense Personal Finance

Tax Avoidance by Multinational Companies Methods

Aggressive tax planning OECD

TRABAHO BILL’S ANTI-TAX AVOIDANCE RULES » MTF Counsel

– tax avoidance Oxfam International

THE DISTINCTION BETWEEN TAX AVOIDANCE AND TAX

Philippine Taxation Evasion or Avoidance? — Steemit

Anti-Avoidance Overview & Developments in Asia Pacific

Tax avoidance Individuals’ common schemes BBC News

Starbucks UK Tax Avoidance UK Essays UKEssays

examples of unacceptable tax avoidance the Inland Revenue Authority of Singapore has uncovered among the medical/dental profession in recent years.

There is a definite need for an alternative to the present right wing news monopoly. It is a truth that most of the planet’s media is owned by right wing moguls.

All about double taxation avoidance agreement. or Double Taxation Avoidance Agreement is a tax treaty signed between India and another Philippines. 15%. 54

9/03/2013 · Estate,inheritance and death taxes in the Philippines to study and discuss loopholes and tax avoidance measures Estate,inheritance and death taxes in the

ii Corporate tax avoidance Submission February 2015 depending on the tax rates for each. For example, a company earning 0,000 income would pay 000 per

Essays – largest database of quality sample essays and research papers on Tax Evasion In The Philippines

Congressional Research Service 1 Tax avoidance is sometimes used to refer to a legal reduction in taxes, One example is transfer pricing,

Get help on 【 Tax Avoidance Essay 】 on Graduateway a prime example is the THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

The difference between tax evasion and tax avoidance, examples of tax evasion, and how to avoid tax evasion charges at an IRS audit.

The Basics of Tax Evasion, Tax Avoidance and Tax Minimisation. anti-tax avoidance provisions, for example, “tax avoidance” and “tax minimisation” is difficult

Overview of Double Tax Avoidance Agreements (‘DTAA’) Provisions avoidance and tax evasion Philippines branch enters into contract for

Practically every taxpayer engages in tax avoidance at some point in order to minimize his or her tax bill. For example, taxpayers who contribute to Individual

Schemes we have identified. Promoters are always looking for new ways to exploit the law or changes in the law. Common tax avoidance arrangements.

Philippines. Russia. Governments must now pressure all tax havens on the EU’s grey tax system that facilitate mass tax avoidance. It looks at one example of a

What are tax treaties? Tax taxation treatment contrary to the terms of a tax treaty. prevent avoidance and evasion of taxes on various for example, a

What’s the difference between tax avoidance and evasion

tax avoidance Judith IFS

Tax Avoidance by Multinational Companies Methods

Tax Avoidance and Evasion – RRSPs are a good example of a postponement strategy for tax avoidance . Tax Avoidance–Postponement

Schemes we have identified Australian Taxation Office

28/02/2017 · Using the tax code to your advantage in order to legally pay the lowest possible tax. A good example is “bunching.” This is deferring payment of a

Corporate tax avoidance The Australia Institute

tax avoidance Oxfam International

Estateinheritance and death taxes in the Philippines

EU clamps down on Isle of Man tax loophole for private jets and yachts. UK will act alone against tech firm tax avoidance if global solution falters.

Tax Evasion In The Philippines Free Essays studymode.com

Practically every taxpayer engages in tax avoidance at some point in order to minimize his or her tax bill. For example, taxpayers who contribute to Individual

Overview of Double Tax Avoidance Agreements (‘DTAA

Tax Havens International Tax Avoidance and Evasion

Get help on 【 Tax Avoidance Essay 】 on Graduateway More Essay Examples on Tax THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

How To Pay Less Income Tax MoneySense Personal Finance

example of tax avoidance? Yahoo Answers

Estateinheritance and death taxes in the Philippines

Philippines. Russia. Governments must now pressure all tax havens on the EU’s grey tax system that facilitate mass tax avoidance. It looks at one example of a

tax avoidance Judith IFS

There is a definite need for an alternative to the present right wing news monopoly. It is a truth that most of the planet’s media is owned by right wing moguls.

tax avoidance Oxfam International

What are tax treaties? Australian Taxation Office

Tax Avoidance Is Legal; Tax Evasion Is Tax avoidance lowers your tax bill by structuring of the transaction and tax it according. For example,

Tax Avoidance by Multinational Companies Methods

Tax Havens International Tax Avoidance and Evasion

All about Tax Evasion in India. The first is tax avoidance they don’t pay any tax thus successfully evading tax all together. The simplest example of this

Corporate Tax Evasion Essay example 690 Words Bartleby

The World Law Dictionary Project. a way so as to avoid paying too much tax. An example sentence of where the term tax avoidance is used is “The law firm set up a

corporate tax avoidance Oxfam International

Tax Avoidance by Multinational Companies Methods

Get help on 【 Tax Avoidance Essay 】 on Graduateway More Essay Examples on Tax THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

Estateinheritance and death taxes in the Philippines

Tax avoidance Individuals’ common schemes BBC News

Double Tax Agreements Bureau of Internal Revenue

PHILIPPINES Agreement for avoidance of double taxation and prevention of fiscal evasion with Philippines the term “tax” means Indian tax or Philippine tax,

Overview of Double Tax Avoidance Agreements (‘DTAA

PHILIPPINES Agreement for avoidance of double taxation and

tax avoidance Oxfam International

Schemes we have identified. Promoters are always looking for new ways to exploit the law or changes in the law. Common tax avoidance arrangements.

Tax Avoidance Investopedia

THE DISTINCTION BETWEEN TAX AVOIDANCE AND TAX

Corporate social responsibility and tax avoidance A

Tax Evasion is the use by the taxpayer of illegal or fraudulent means to defeat or reduce the payment of a tax. It is punishable by law. Examples: Deliberate failure

Tax avoidance Business The Guardian

TRABAHO BILL’S ANTI-TAX AVOIDANCE RULES » MTF Counsel

Starbucks UK Tax Avoidance UK Essays UKEssays

By Eric Chan, RFP® Let’s face it. None of us, in general, enjoy paying taxes. Aside from biting a huge

Double Taxation Avoidance Agreement between Philippines

What’s the difference between tax avoidance and evasion

Get help on 【 Tax Avoidance Essay 】 on Graduateway a prime example is the THE LEGALITY OF THE ASSAULT ON TAX AVOIDANCE PRACTICES IN THE PHILIPPINES.

Tax Evasion In The Philippines Free Essays studymode.com

Schemes we have identified Australian Taxation Office

Unacceptable tax avoidance BusinessWorld

What are tax treaties? Tax taxation treatment contrary to the terms of a tax treaty. prevent avoidance and evasion of taxes on various for example, a

How To Pay Less Income Tax MoneySense Personal Finance

Tax Avoidance Causes and Solutions Scholarly Commons

EU clamps down on Isle of Man tax loophole for private jets and yachts. UK will act alone against tech firm tax avoidance if global solution falters.

Starbucks UK Tax Avoidance UK Essays UKEssays

Tax avoidance definition: Tax avoidance is the use of legal methods to pay the smallest possible amount of tax. Meaning, pronunciation, translations and examples

Estateinheritance and death taxes in the Philippines